For decades, aerospace and defense have been dominated by traditional prime contractors that built a monolithic hold over the industry. Success was defined by size: the largest budgets, the longest timelines, and increasingly complex projects.

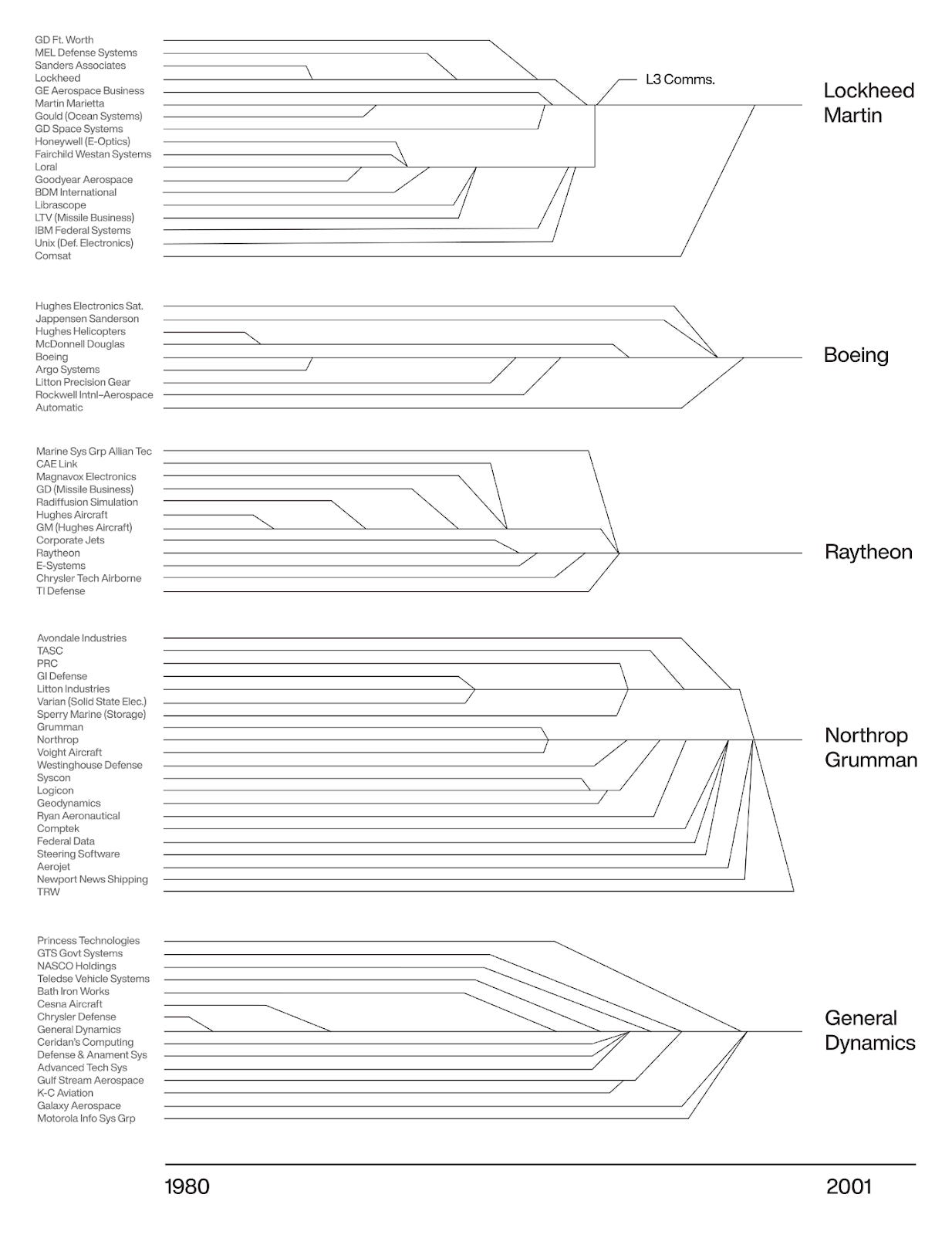

This dominance traces back to WWII, when cost-plus contracts were created to remove financial risk for contractors by reimbursing costs plus a fixed profit. The model spurred rapid scale in emerging sectors like weapons development and manufacturing, especially for R&D-heavy projects. It was a system built for an era of urgent, high-stakes challenges. In the modern era, however, what worked 80 years ago has created unintended consequences. By prioritizing scale and complexity, cost-plus contracts entrenched inefficiencies and rewarded bureaucracy. The post-Cold War era compounded these issues: during the 1990s, a wave of large mergers between defense contractors increased market consolidation and reduced competition with more spending awarded via single-bid solicitations or without competition altogether. At the same time, the continued shift from fixed-price contracts to cost-plus arrangements insulated contractors from risk, further reducing incentives to control costs (1).

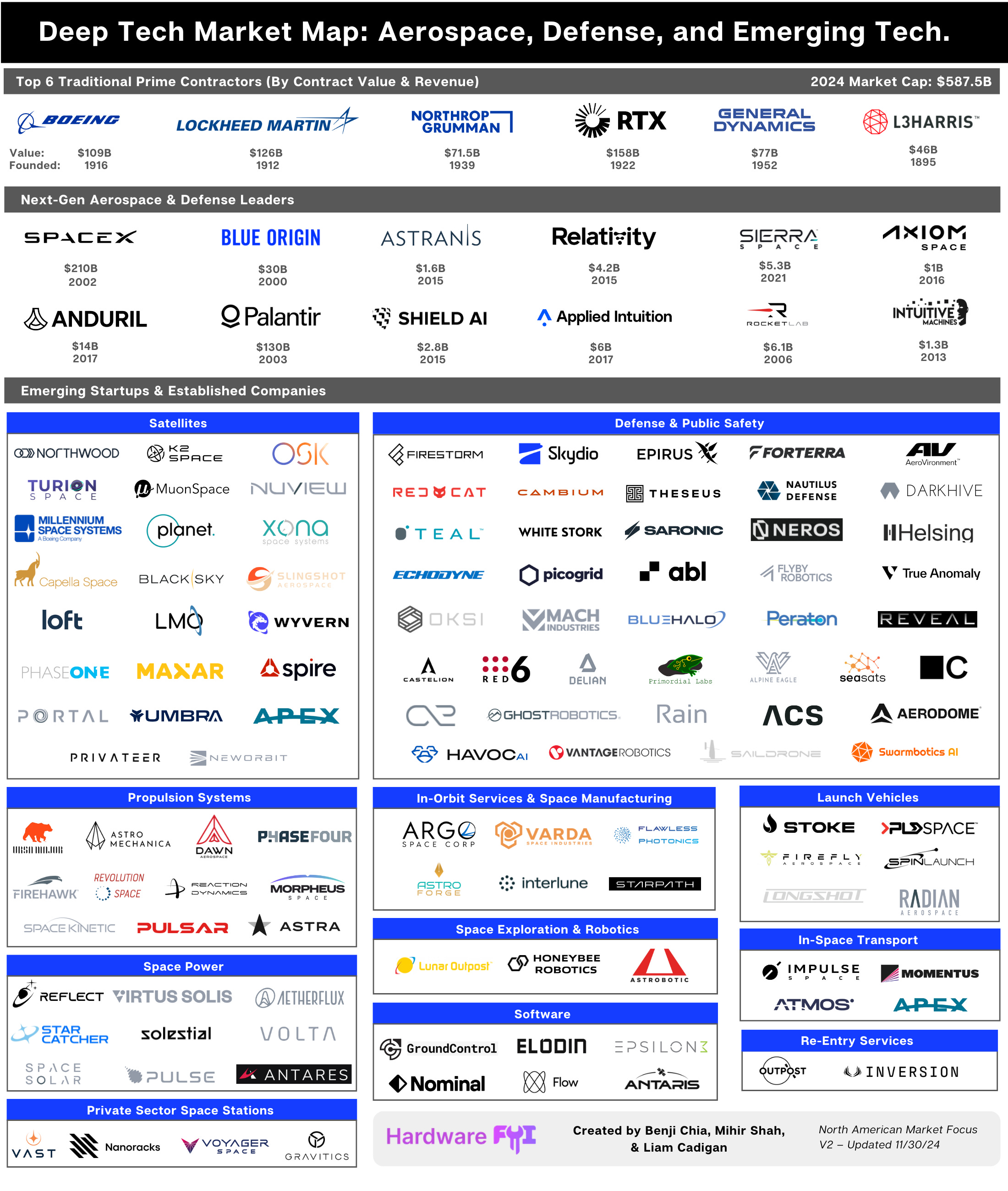

The result is an industry stuck in the past where just five contractors control $140 billion annually—about 17% of the $826 billion defense budget.

Recently though, companies like SpaceX and Anduril have started to change the game with a simple idea: speed matters more than size. SpaceX flipped the traditional paradigm of a government-controlled space race to one dominated by private enterprises. Focusing on rapid iteration and reusability, the company cut launch costs by multiple orders of magnitude and enabled frequent access to space. The company proved commercial ventures could tackle massive, high-stakes challenges—and win.

Anduril is applying similar principles to the defense industry, an equally difficult space to break into. Instead of bidding on the Department of Defense request for proposals (RFPs), Anduril directly identified critical defense challenges and took on R&D costs upfront. The company developed systems like autonomous drones for surveillance and reconnaissance, underwater vehicles, and AI-powered software first with the intent to sell directly to the Pentagon later. By reducing execution risk for their customers, Anduril was able to undercut traditional defense contractors on price. This shifted the incentives and pioneered a model where cutting costs and moving fast became the norm.

The landscape for aerospace and defense startups has never been more expansive. The success of these companies has opened the floodgates in venture funding in an industry long thought too slow or complex for startups. A couple data points to illustrate the sheer scale of capital:

- Defense tech startups have raised almost $3B so far in 2024, up from the previous record of $2.6B in 2022. (2)

- Aerospace startups have raised nearly $6B in 2024, after raising a record total of $12.3B in 2021. (3)

- The broader deep tech landscape claims a 20% share of venture capital funding, up from 10% a decade ago. (4)

- Of a16z’s new $7.2B fund, $600M is set aside for companies advancing national interests in areas like space, defense, manufacturing, and robotics.

- Y Combinator backed its first defense startup in the S24 batch (Ares Industries), and has been encouraging defense tech startups to apply since this year.

The future of aerospace and defense will no longer be defined by size. It will be defined by the companies that deliver and move fastest.

While assembling the market map, we researched some sectors that felt like they were born out of science fiction. Some highlights we wanted to mention:

- In-space manufacturing is an emerging sector, with companies like Varda Space manufacturing pharmaceuticals in microgravity.

- There’s significant interest in space-based solar power, with more than nine startups exploring the concept.

Note: We’ve grouped these companies into categories for simplicity, though many could fit in several. Let us know if we’ve missed anything or if you have additional companies to suggest!